You know to unlock these goals, you need Python for data, analysis, and trading.

So you took a $19 online course.

You learned how to build a tic-tac-toe game from someone that has never traded, done financial analysis, or even worked in finance.

Or more useless theory that doesn't get you any closer to your goals.

I've been there.

You've read the blogs, watched YouTube, and taken all the courses.

But actually using Python for quant finance in real life (and not just for toy examples)?

That can seem like something other people figure out, not you.

Instead, you're...

Sound about right?

For many of us, getting started with Python is a mystery.

You know there is immense power at your finger tips, but you just can't quite figure out how to go from theory to practice.

Modules, IDEs, swaps, options, Jupyter, functions, automation, backtesting, loops, classes, CVaR, Sharpe, list comprehensions, walk forward analysis...

People may as well be speaking another language.

Hi there, I'm Jason and I'm the creator of Getting Started With Python for Quant Finance.

I can translate that language for you.

I've been trading for over 20 years, a quant for 15, and a daily user of Python for 12.

In October 2022, I started helping other people learn how to put the three together.

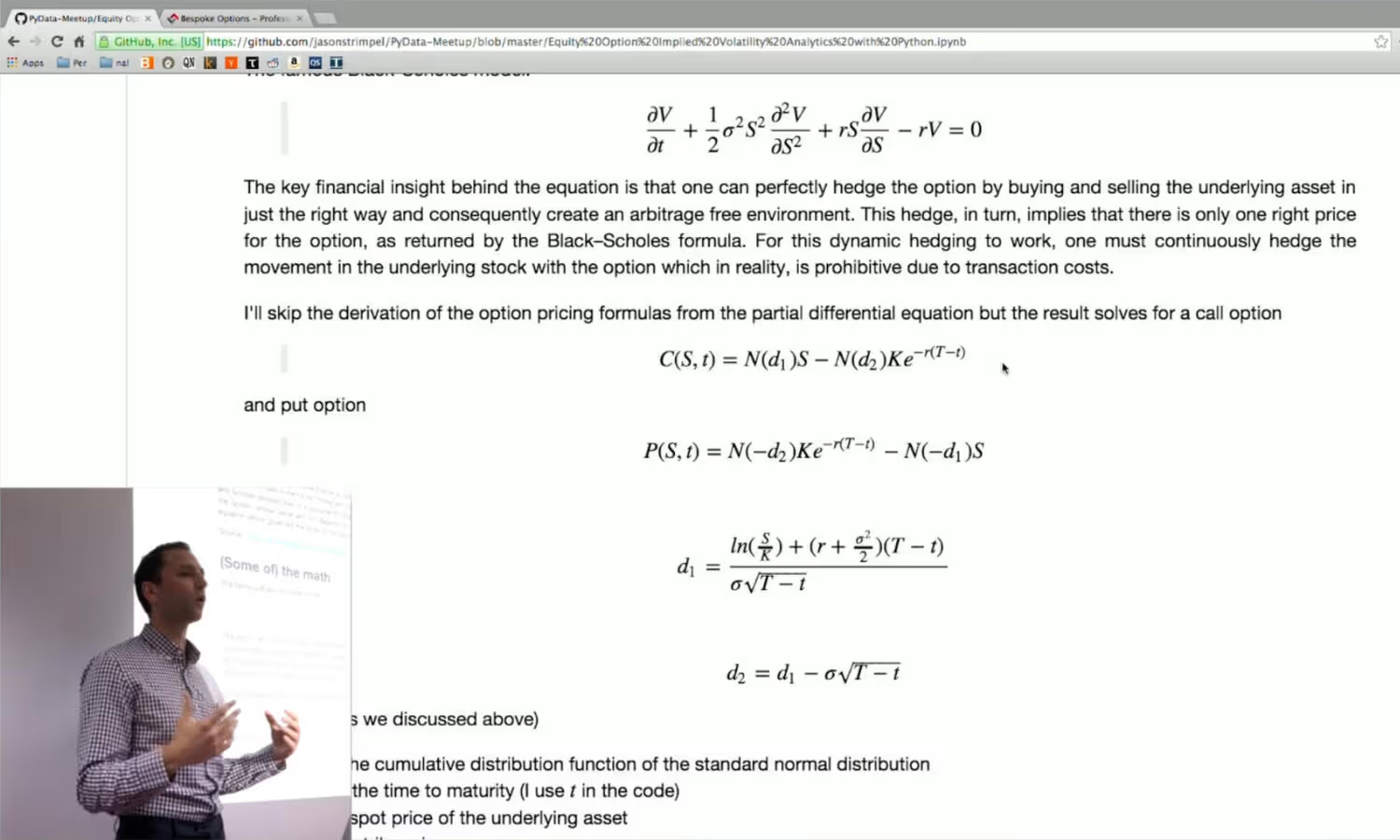

Over the years, I've helped hundreds of finance professionals, developers, and complete beginners use Python for quant finance. I've done this through keynote talks, Meetups, Twitter threads, LinkedIn posts, in-depth articles, newsletters, and my course Getting Started With Python for Quant Finance.

It's a complete set of step-by-step, proven frameworks that gives you:

It means that you won't waste time learning Python you can't use. It means you'll get the skills for a new quant job or to start trading from home.

You get the same quant tools I used to analyze $20 billion of derivatives credit exposure, manage $100 million book of CVA, manage a global team of quant engineers, and trade stocks and options.

So if you're struggling to get started with Python for quant finance, this course is for you.

Sound about right?

The course gave me the materials I needed with a mentor to guide me along the way to achieve my end goal of landing an active trader role. Jason gets straight to the point and avoids all the fluff that other courses use that wastes a tremendous amount of time.

I've explored most of the quantitative finance courses out there and found this to be the most practical and efficient course currently available. If you want to quickly increase your confidence and productivity with Python applied to trading strategies then take this course.

Great course whether you're a beginner or an experienced Python user. The shared notebooks alone are worth multiples of the course cost. I signed up for round 3!

We kick off with the very basics of Python. We cover primitive data types, data structures, control statements, functions, and classes. This is a practical but critical introduction to Python!

The most important library you’ll use is Pandas. You can use pandas for 80%+ of all work you’ll do in quant finance. In this module, we dive deep into several practical examples of using pandas for market data analysis.

The harsh truth is most people get algorithmic trading, backtesting, and strategy formation wrong. In this module, you’ll understand how non-professional investors can compete, how to backtest the right way, and the 8-step process for strategy formation.

Most people think backtesting is all about optimizing input parameters to maximize profit. That’s exactly the wrong way to backtest. In this module, you’ll see how to statistically test a backtest and shift your framing of backtesting forever.

VectorBT is an advanced vector-based backtesting framework that simulates millions of strategies in seconds. In this module, we’ll analyze our example crack spread trade and optimize the entry and exit z-score signals.

Most people have heard of alpha. Most people even have a concept of alpha. Few have the technical understanding of alpha. In this module, we’ll define alpha, discuss how to hedge beta to isolate it, and build alpha factors to capture it.

Zipline Reloaded is the most robust event-based backtesting framework available. Zipline Reloaded is great for backtesting portfolio strategies based on alpha factors. In this module, we’ll use Zipline Reloaded to backtest an alpha factor.

Risk and performance analysis is critical. Luckily for us, a suite of tools plays nice with the Zipline Reloaded backtesting framework. In this module, you’ll get intuition on how to use risk and performance metrics to improve your investing and trading.

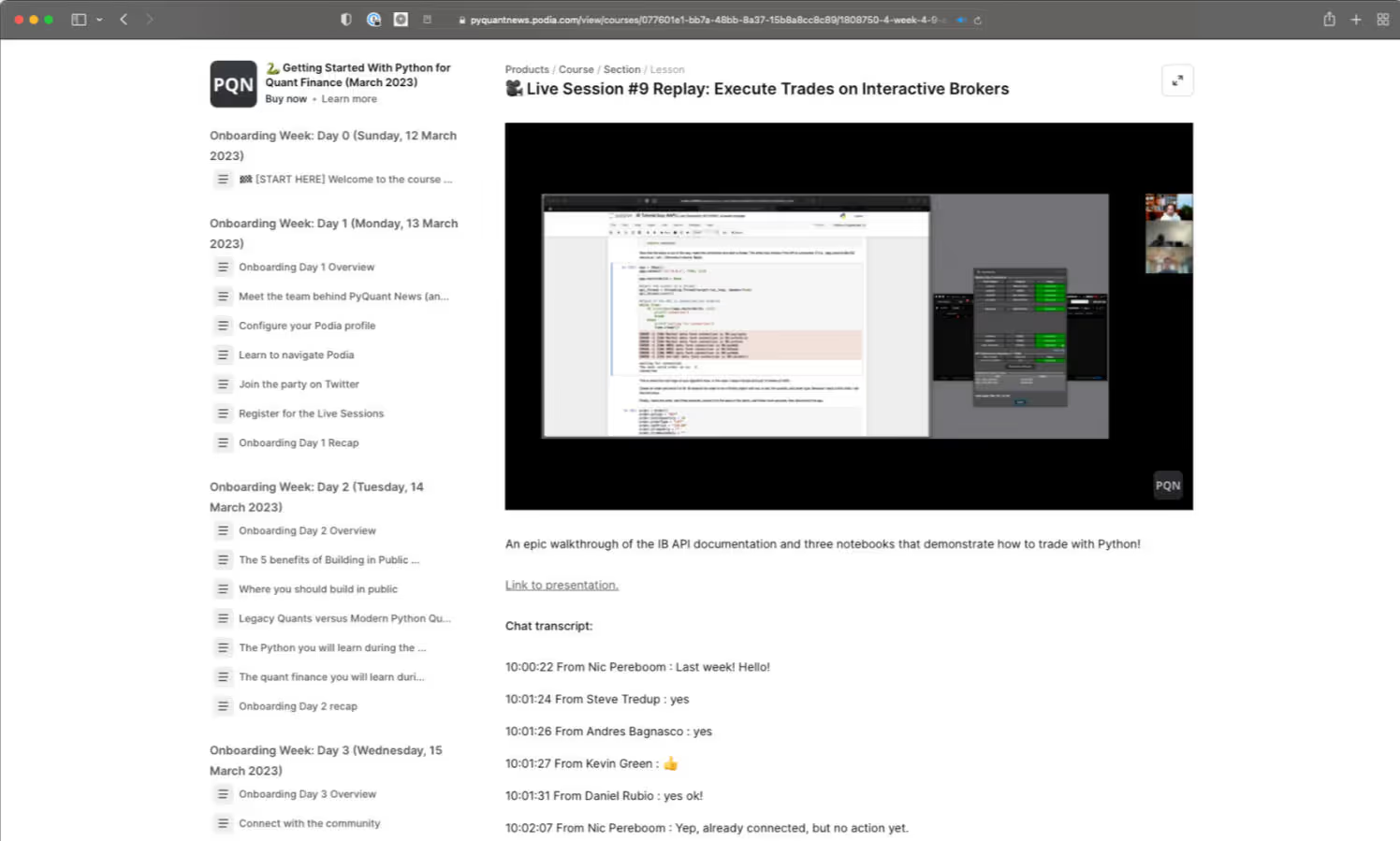

The last step of the algorithmic trading pipeline is executing trades. Unfortunately, it’s tricky to get right. In this module, we’ll build the basic scaffolding for a trading app using the Interactive Brokers API.

Whether you were writing code every day or missed a few, making it through the course is no easy feat. So, in this final module, we will recap everything we learned and discuss how you can take the next steps to continue your Python journey!

This was by far the best trading class I have ever taken.

I have no coding experience and no technical background. I went from no direction with Python to having a clear path in a month.

I consider it one of the best investment decisions I have taken this year. Five weeks ago I didn't know what quant finance was and I only knew some basics of Python. Since I took the course, a new world has opened to me which will boost my options trading.

My name is Jason Strimpel and I'm the creator of Getting Started With Python for Quant Finance.

I traded my first stock and wrote my first line of code when I was 18.

Since then:

☀️ I traded professionally for a hedge fund and an energy derivatives trading firm in Chicago wracking up several millions of dollars in profit.

️☀️ I was a credit quant looking after $20 billion in credit exposure and managing $100 million of CVA exposure.

☀️ I managed a global, quant engineering team that built all the market risk analytics for a $7 billion derivatives trading business.

☀️ I built and led the data engineering and quant-analyst team for a $60 billion metals trading business.

☀️ I taught myself Python in 2012 to avoid spending $2,000 per year on a MATLAB license after finishing my master's degree in quant finance.

I trade stocks and options in my free time using Python for data acquisition, automation, and execution.

My quant career has allowed me to live and work in 3 countries (the United States, England, and Singapore) and travel to 41.

I started PyQuant News in 2015 to share what I knew about Python for quant finance.

Nine years later, I'm still at it.

I learned much from this course about both Python and quant finance, all of which was dependent upon the incredible support provided by Jason individually and by the PQN community. Highly recommend.

You have lifetime access to the PQN Pro community, the self-paced modules, code notebooks, and written course curriculum. That way, you can follow along at your own pace!

You can go at your own pace. Plus you have 1,300+ people that can quickly help you debug your code, answer questions, and get you unstuck to keep learning.

I built a business on trust. I am public online and have tied my personal avatar on social media platforms (including LinkedIn where my posts are monitored) to the PyQuant News avatar. 1,000+ people have trusted me to get them outcomes with Python. You can too.

Here's the dirty secret of Udemy, Datacamp, Coursera, Udacity, Code Camp, and others: Their business model requires you to take course after course after course. So they teach the most general topics to the broadest audience possible to get the most users on their platform. Their incentives are not aligned with yours. Mine are: Get you outcomes with Python for quant finance. I lose if you can't use what you learn.

Things like conditional value at risk, factor investing, and options valuation work in all markets. The code templates are meant for you to modify as you need to!

No! Of the 40 code templates, 3 of them are specific to Interactive Brokers. 99% of the course is applicable to any broker.

It helps if you have some exposure to programming Python before taking the course. The first Live Session covers the basics of Python and the second Live Session covers the basics of pandas, but it ramps up quickly from there.

Yes! I've had people in my course that were software engineers for 30 years. These folks can quickly use their experience for quant finance.

I'm assuming that if you're considering buying Getting Started With Python for Quant Finance, then you likely have been following me on LinkedIn or Twitter. I don't run ads, so the chances that you've stumbled upon this product through some Facebook or Google advertisement is zero.

I've spent the last 5 years building a reputation online as someone who delivers the highest quality products. I have 1,300 students, a less than 0.1% refund rate, and over 100 5-star reviews with an aggregate score of 4.97 out of 5.

This course is packed with 20 hours worth of instructional content. It's the thing I wish existed when I started back in 2012.

This course is not for people who are on the fence. It's not for "tire kickers" or folks who are just "poking around."

It's for people who are familiar with my work, understand how important quality is to me, and want to put in the work necessary to see the results.

If that's not you, please don't buy the course. If you're just "curious" and want to watch a few lessons and quit, please don't buy the course.

If you're committed to the process and want to learn everything that I've learned over the last 15 years, there's zero chance you'll be disappointed.

Thank you for understanding.

Life is busy. I know you don't have time to work on Python all day. That's why this course is designed to be done in less than 1 hour per day.

This course helped unlock outcomes because of the community aspect - people asking questions to each other and sharing their code. There were multiple circumstances where I got stuck and was able to pass through by asking questions and leveraging other people's code. The community is the biggest differentiator.